What distinguishes the car trade?

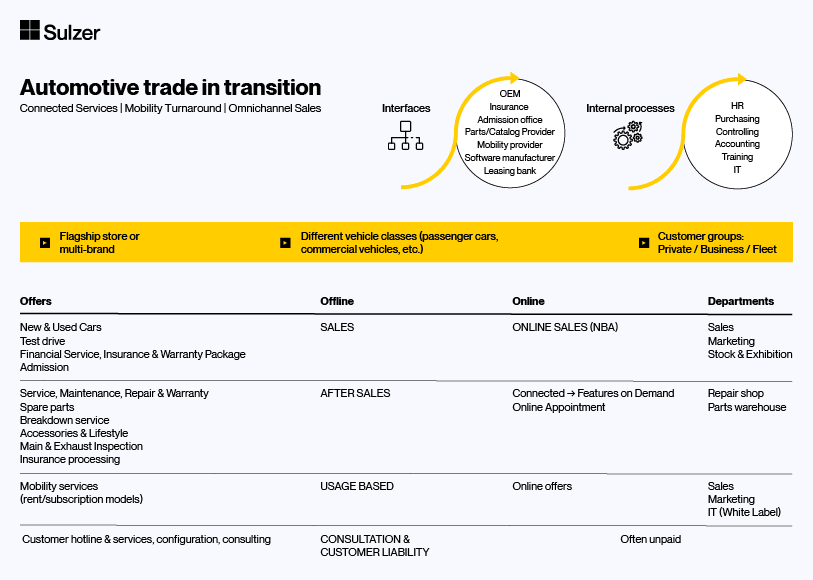

The car dealer as we know it handles, among other things, the sale of new and used vehicles, aftersales business, repairs and related services such as service, maintenance and warranty processing. Going more in-depth, many other services emerge, such as leasing and financing, insurance, vehicle registration, spare parts, accessories and lifestyle product sales, and much more.

A dealership’s service and product portfolio can be extremely diverse. Therefore, it is very crucial for a dealer to decide, for example, whether to pursue a single-brand or multi-brand strategy, providing the complete portfolio of a manufacturer or only parts of it.

Two assumptions are important here:

- A retailer must maintain a great deal of expertise with its workforce. Today’s customers can obtain preliminary information on the Internet and then want a statement from the salesperson based on experience. This personnel-intensive business model requires extensive employee training. The aim is to understand the customer, to be able to operate the IT systems, and to have the technical knowledge for the complex product and to be able to call on this knowledge in customer contact. The challenge here is to understand the brand world, convey the brand message and ultimately close the sale.

- Dealers have merged to form large chains and car dealerships. There are many drivers for this, some of which are manufacturer specifications, the diverse model range of an OEM and also cost pressure or financing requirements. Through the merger, central business processes are bundled and optimized, and resources, warehouses and also know-how are shared.

Automotive retail and aftersales are heterogeneous

We are experiencing strong market concentration and specialization. If we look at the various dealership organizations holistically, they are very inhomogeneous. Specialization on a product portfolio and, if necessary, on different customer groups is what defines a dealer.

For example, there are two German car manufacturers that also offer minibuses and delivery vans. Thus, the business here falls much more into the commercial sector. However, dealer can also offer customizing or aftersales for these vans. There is no doubt that the business with delivery services and business customers is different. Not only the vehicle technology itself, but also the maintenance requirements differ.

It is up to dealers and workshops to include any other type of specialization in their range of services, such as vehicle tuning. Furthermore, dealers and workshops focus on special vehicles, such as campers, cabs or emergency vehicles. However, you can also find dealerships without a workshop that only sell vehicles, and a used car dealership reduces its scope of services even further. There are also businesses that only take care of delivery or only sell vehicles online.

If you look at the different dealers and dealer groups, there is always a certain focus. The possible range of services is so extensive and varied that it cannot be mapped holistically.

Connected services

Currently, the most important driver in the change process is the expansion of Connected services. The existing services already have an impact on dealers and workshops and are being continuously developed. Connected services have given OEMs – in addition to their own dealerships – the opportunity to engage directly with end customers, giving them their own customer touchpoint.

The current Connected services with largely direct contact between the end customer and the OEM platform can hardly be realized in any other way because the platform has to be operated centrally. OEMs have taken care to maintain this triangular relationship with the dealer – whenever it is necessary and makes sense. Examples include booking a workshop appointment in the vehicle or maintaining the electronic checkbook. As is well known, the American carmaker Tesla takes a different approach here, foregoing the involvement of the automotive dealer.

If the customer is assigned to a dealer, then the dealer is addressed when these services are used and not the OEM’s own branch. The data issue is of particular relevance here, however, because from the OEM’s point of view the Connected services establish a direct link to the customer. Before their introduction, the OEM only addressed a vehicle and not the customer.

At this point in time, the handling and the associated business model with regard to the Connected services is still relatively simple, as these services are selected as optional extras – accordingly in the configuration process of the purchase – and added accordingly. Although the offerings relating to Connected services are regarded as a decisive criterion for purchasing, they generate only small revenues in relation to total sales.

Function-On-Demand

Function-on-Demand changes the established service model in that new sales processes take place during the product lifecycle of a vehicle. The extent to which a dealer will be involved in this has not been finally negotiated. Accordingly, there will be numerous cases in which a customer purchases a function in the vehicle while on the road that no longer has any connection to the dealer.

The vehicle manufacturer offers additional features via the Connected functions, which can also be booked regardless of location and time. These functions may already be available when the new car is sold, but may be deactivated. In some cases, higher-value hardware equipment is already provided for this when the new car is sold. There may also be the case that this feature was only made possible with a software update after the new car sale, or perhaps a software update becomes necessary after the customer has purchased the function.

It can be assumed that in the future there will be functions with varying degrees of dealer involvement for this purpose:

- Functions where the merchant is actively involved in the process and the sale of the services is made on their behalf. Consequently, there will be a distribution of the margin.

- Functions that are not relevant to the dealer will not be available to him.

- And a middle ground where the function can be sold directly and indirectly.

In addition, it can be assumed that the OEM will work on a customer journey for these services, so that the dealer does not have to be involved. The reason is to avoid the commission and increase their own margin for this service. For the OEM, the challenge is to use the driver’s attention to the Human Machine Interface (HMI) – called user interface in German – to offer the right offer at the right time to the selected customer group.

In the long term, enormous revenue generation can be expected at the HMI with vehicles in the field, flowing past the dealer. The pressure on margins when selling vehicles in developed and saturated markets is quite high. Today, the dealer therefore mostly profits from the sale and installation of original parts in aftersales, which means that the necessary profit can be generated here.

Function-On-Demand will promote this effect much more. The exploitation possibilities can no longer be reduced to the classic aftersales business, but basically it is the daily hour of driving time and the attention of the driver (= customer) that can be exploited. Autonomous shuttles that are shared across many customers can exploit these exploitation opportunities far more because the driver’s attention no longer needs to be focused on the road.

The future role of the dealer can be well derived from other industries. The example of this is insurance sold through direct sales and, in parallel, through brokers. It happens that a broker takes over an insurance policy already sold directly into his maintenance portfolio if the customer agrees. The broker then receives a commission, usually in the form of a share of sales, as compensation for maintaining contact with the customer.

Similarly, in the telecommunications industry, there are revenue-sharing models for term contracts that help ensure that a fair commission calculation is made for a dealer, even if the revenue is generated over many years. In the future, there will be a variety of business transactions that can mean both a one-time payment and a long-term contract.

With Function-on-Demand, the merchant will be partially involved: The customer will have questions about certain functions, and the dealer will seek compensation if staff have to be trained and kept on hand to perform them.

The manufacturer will try to provide these functions with a sophisticated digital customer journey that does not include the need for explanations in order to avoid exactly this. Most importantly, the effort to perform bonus calculations will increase, either because the sales performance is distributed and thus the bonus is spread across multiple parties, or because the calculation is not simply based on a single sales event.

It is crucial for the retailer to understand the bonus models in order to target his staff. He must avoid providing service without being compensated for effort. Specifically, the dealer must align his efforts, training and sales process with the commission payment.

Sale of vehicles

The upheaval can also be seen in the sale of new and used vehicles. Here, too, there is a shift from pure offline business to online platforms. Sales are increasingly shifting to the Internet – particularly in highly competitive markets such as Germany, this process of change is very advanced.

New car sales are being boosted by comparison portals. This also gives dealers the opportunity to communicate and distribute their offers throughout Germany via these platforms. For the dealer, the advantage is that these new offers promote his sales nationwide and thus annual targets can be better achieved.

If we look at the shift from offline to online, the leasing business in particular should be mentioned here, which is gradually migrating to the online channel. The basic prerequisite for successful online sales is data quality. Various startups are familiar with configuration and price data to ensure efficient processing. The sales service for a new vehicle is increasingly decoupled into the following specialized market participants:

- The OEM provides configuration, image and pricing data via an application programming interface (API). Often, the customer also switches to the configurator at the manufacturer, primarily to find the configuration that suits him.

- A comparison portal serves as an additional sales channel for vehicles with leasing rates. The customer looks for the suitable vehicle here.

- A dealer grants the discount and serves as a broker for the leasing contract, if a fleet operator does not do it directly.

- The automotive captive is usually the lessor. There are also other lessors operating in the market.

- A delivery company organizes the handover to the customer and the return, perhaps also the reconditioning of the vehicle.

- Branches and the dealer network provide service and aftersales.

- In some cases, there is also a fleet operator who holds the maintenance and service contract. This fleet operator makes sense especially if it obtains key account discounts.

This example shows how the dealer is involved in the sale of a vehicle in places and at certain points. It is important to note here that the classic image of a dealer is becoming increasingly blurred. The above examples show that the delivery company and also the sales platform serve specialized processes. They thus handle only small sub-aspects of the classic dealer.

The car trade has become increasingly professionalized with the result that large trading groups with sales in the billions have emerged. As a result of the new market players with a high degree of specialization described above, a reorganization of the existing car trade is taking place. This is primarily driven by startups that take over a function in sales and achieve efficiency gains through this specialization and automation.

These new market participants have a high degree of diversification and they specialize in niches. Examples include:

- Multi-brand portals for new vehicles, as well as for used vehicles.

- Comparison portals for new vehicles or leasing contracts

- Specialists for leasing returns

- (Online) appraisers or vehicle valuers

The raison d’être or competitive advantage of these solutions is often the optimized interface to the customer, in some cases the well-designed customer journey, the broad range of products and services, or simply cost efficiency. Overall, it should be noted that selling a vehicle can already be an extremely fragmented process, with the customer deciding how and where to buy, whether offline or online.

Lead generation, fragmentation and omnichannel

We have already illustrated that the sales process of new and used vehicles is becoming increasingly fragmented. Already during lead generation, this increasing fragmentation is also noticeable.

The car is a highly configurable mass product, and its sales process is the prime example of “mass customization”. The sales process requires a great deal of know-how and effort for the entire organization – starting with the OEM and extending to the sales and retail organization and the dealership. In addition, German automakers set themselves apart from the rest of the market with the large number of optional extras they offer. This combination of the high product price, the extreme diversity of variants and the high complexity of distribution, make the automobile unique in the end customer market. The expert advice of a car dealer guarantees a premium experience here above all else.

The complexity of vehicle sales and customer acquisition is already reflected in the various marketing activities and the associated customer touchpoints. This increasing fragmentation is already taking place here – both online and offline. These channels are no longer decoupled: a customer’s journey can start with the printed flyer, transfer to the online world via the scanning of a 3D code, and end with an appointment entry for an offline or online event.

Customer engagement therefore takes place in many parallel activities, all of which must be seamless. Each piece of data generation in this fragmented process is an important piece of the puzzle that must be assembled at the end to form a customer requirements profile. This purposeful interplay between on- and offline results in the customer receiving an individual offer that fits them exactly, resulting in a fully comprehensive customer experience.

This seamless transition requires perfect data exchange between the retailer and the OEM. This is precisely where the challenge lies, because this customer data also represents the corporate value of a dealer. The customer base had to be continuously built and maintained. Ultimately, the dealer himself had to invest in order to bundle a salesperson’s customer data in a CRM system.

This customer data can be exploited directly, with the “Next Best Offer”. Targeted measures to this end promote loyalty and long-term customer retention. Above all, they create measurable sales success.

Aftersales, service and workshops

Aftersales is dominated by service and repair. Special requirements are found in warranty and claims processing, since here, in addition to communication with the customer, coordination with the OEM must also take place.

Modern diagnostic systems expand the possibilities of workshops and contribute to a rapid reduction in the effort required for fault analysis. This is countered by the increasing number of vehicle models and variants, as well as the increasing complexity of the installed electronics, so that sources of error are increasing exponentially. Driver assistance systems and connected services are expanding the dimensions of error sources.

However, new technological developments will turn processes and approaches in repair and service upside down. Virtual reality-based employee training and augmented reality-based repair instructions will be widely used in the near future. Technology has reached maturity to bring greater efficiency and quality to repair and service.

Repair acceptance, logging and many other administrative processes are also becoming increasingly digitized. Modern diagnostic options such as predictive maintenance ensure in advance that the right parts are in stock so that the customer does not have to wait unnecessarily. The interface to the customer also plays a significant role here, as the digitized processes described above have an effect on online appointment scheduling.

Mobility turnaround in the car trade

Where does that leave the dealer when cars drive autonomously, electric vehicles hardly need any maintenance, all vehicles are connected and car sharing has reached the masses?

The mobility turnaround is advancing: mobility and the transformation is characterized by dynamism and an enormous wealth of ideas based on a wide variety of customer needs. This will also have an impact on the business model of the car trade.

People want or need to be mobile, whether they are going shopping, cruising the Alps in a sports car or needing a van for moving house. In all these cases, mobility needs are different and volatile. Mobility and the mobility turnaround mean creating a user-centric approach that serves these heterogeneous needs with different mobility offerings. However, the basis of the new services is still often a vehicle.

And that is precisely why the dealer can play a very central role here. Local proximity in particular allows the dealer to create a range of services that is close to the market and the customer, and which actually meets the general conditions and thus covers a real need. This can include, among other things, the service and maintenance of vehicles in the new mobility environment.

Furthermore, the retailer can offer its own storage and replacement vehicles in order to increase the utilization of these – especially on weekends or after closing time. In addition, complementary measures, such as the rental of special accessories like bike racks or a ski box, can be useful additions. As a result, retailers are increasingly developing into a kind of “mobility service provider” with their existing core competencies.

Two of the most important trends or mobility offerings that are gaining acceptance right now among a wide variety of customer groups are car-as-a-service and car subscription models. Both trends mean a flexibilization of the customer offer and the approach to an all-round carefree package, which underlines the concept and importance of servitization. The customer hands over responsibility almost entirely to the provider.

Car-as-a-service usually involves flat rates: These include vehicle service, maintenance, tire changes, warranties or other services that can be put together in a car-related package. The service and risk is then priced accordingly by the providers, including OEMs or insurance companies. This service was already common for business customers and is now increasingly conquering the private customer segment. Here, the dealer usually takes over the services on site and is the local contact and sales partner.

Car subscriptions go one step further. They are very similar to long-term rentals because the customer is ultimately provided with a vehicle for months at a time. And that’s where the dealer comes in. A car subscription is composed of the very services that a dealership can provide. A provider finances a vehicle, offers it to the customer for a period of time, handles registration and delivery to the customer, handles service, repairs and takes the vehicle back.

The use of a vehicle that is ready to drive is the service that the customer buys and the customer has even a bit less responsibility. The customer is no longer concerned with issues such as purchasing winter tires, the car subscription provider provides them.

The dealer also has the option here to offer his own stock and replacement vehicles in the subscription or to include subscriptions from third-party providers in his portfolio. The dealer again brings its advantages to bear – either as a local sales or service partner. In addition, sales are made via online platforms.

The Sulzer GmbH offer to the car trade

Sulzer GmbH has extensive knowledge of the processes and data, the business model, and the IT in automotive distribution as well as aftersales. We understand how sales are generated and in which processes the dealer bears expenses. We are also experts in the field of digitalization.

We advise you on new business models – and evaluate which new specialized market partners and startups have the best chances of establishing themselves successfully. We show you how to cooperate and collaborate with them. Together with you, we look at the market and check which possibilities turn out to be target-oriented for your business and which new collaborations are required for this.

As a full-service IT provider, we offer standard solutions for CRM, ERP and business intelligence, as well as interface connections to market partners. These include registration authorities, vehicle manufacturers, lessors, etc. Of course, the focus is on the interface to the customer, on whose optimization we work consistently and purposefully.

If required, we can also take over the operation of your IT systems. With over 40 years of know-how in the automotive and mobility environment, we are very familiar with OEM connectivity and have numerous references. We know the configurators, order systems, connected systems, dealer portals, content systems for vehicles, and the bonus systems of vehicle manufacturers in detail.

Our specialists develop digitization solutions that either directly save costs at the dealership or indirectly save costs through process optimization. We build cost-effective, quickly set-up systems for a test or pilot operation, but also full-blown, scaling systems for broad and company-wide use.

In addition to our offices in Germany, we are also active internationally on various continents. Together with you, we define the project goal and design a targeted implementation concept.

Authors:

Richard Leitner, Mobility Management

Julia Münsch, Consulting Automotive & Mobility

As a market participant, would you like to learn more about the changes in the car trade?

Our mobility experts will be happy to advise you.